Mortgage deselection is gaining attention due to the heightened state of upcoming mortgage renewals. Particularly, financial institution Scotiabank recently announced incoming renewal strategies that will potentially reduce their book of high-risk borrowers. While this may sound alarming, it’s crucial to understand that for the vast majority of homeowners, the likelihood of non-renewal is minimal. This article aims to demystify the concept of mortgage deselection and offer guidance for those who may have concerns about their mortgage renewal.

The Reality of Mortgage Deselection: Unpacking the Panic

First and foremost, it’s important for homeowners to know that mortgage deselection is not a widespread practice. Lenders, including major banks, credit unions, and mortgage finance companies, usually have policies in place to offer renewals to borrowers. The misconception that banks are actively seeking to ‘get rid of’ clients needs addressing. Most often, non-renewal or “deselection” is a last resort, taken only in cases of significant risk or contract violation.

Understanding Mortgage Deselection

Mortgage deselection refers to a lender’s decision not to renew a mortgage at the end of its term. While this decision could happen for various reasons, it will likely be a rare occurrence for many reasons. The concept has recently gained more attention due to shifts in the real estate market and economic conditions, leading to a more cautious approach by some lenders. This creates the necessity to ensure their portfolio of borrowers continues to be a solid investment.

Proactive Steps for a Successful Mortgage Renewal

For those concerned about their mortgage renewal, proactive steps can be taken to ensure the best possible outcome. ‘Rest assured, if you are paying your mortgage on time, there is no need to panic that the bank is going to get rid of you,’ advises Kyle Wilson, Kelowna Mortgage Broker and CEO of Pragmatic Mortgage Lending. This sentiment is echoed across the industry, emphasizing that timely mortgage payments significantly reduce the risk of non-renewal.

When to Consult a Mortgage Broker

If you have concerns about your mortgage renewal, or if you’ve experienced significant changes in your financial situation. Consulting with a mortgage broker is a key strategy for navigating this process. A broker can offer personalized advice, identify potential red flags in your mortgage journey, and provide comprehensive long-term and short-term plans for your borrowing needs. They can offer guidance on how to address potential issues and help develop a strategy to secure a favourable renewal offer. Whether that be with your current lender, or a more favourable solution with a new lender.

Strategies for Addressing Potential Red Flags

Potential red flags that might concern lenders include late payments, a significant drop in property value, or knowledge of extreme circumstantial changes of the borrower such as loss of employment. If any of these apply to you, a mortgage broker can assist in formulating a plan to mitigate these concerns, such as improving your credit score or exploring options to increase your property’s value. It could be as simple as confirming that the current lender will not have concerns with the scenario and presenting backup solutions.

‘For the majority of folks, expect the status quo with automatic renewal offers and little to no questions asked. Consistent, timely payments are crucial to keep your current lender on their toes. Well before the maturity date arrives, you need to make clear to your bank you are exploring a possible mortgage transfer to get the best rate.’ Wilson advises. This approach can lead to more competitive renewal offers from your current lender.

Adapting to Changes in the Mortgage Market

The mortgage market is dynamic and subject to various influences, including economic trends, housing market conditions, and regulatory changes. Understanding these factors and how they might impact your mortgage renewal is crucial.

The Impact of Economic and Housing Market Trends

Economic factors such as interest rates, inflation, and the general health of the housing market can significantly influence a lender’s decision-making process. Staying informed about these trends can help you better understand the context in which your mortgage renewal will be evaluated.

A saying often attributed to Warren Buffet makes the point: “When the tide goes out, you see who’s been swimming naked.” It emphasizes how economic downturns reveal the true financial stability of individuals and businesses, contrasting with times of prosperity when everyone appears to be doing well. What’s the lesson? In the event of a recession, expect banks to tighten up on previously over-promised conditions. If there are signs of a strong uptrend in the economy or a need to accelerate, expect the banks to be more liberal on their risk tolerance.

Regulatory Influences on Mortgage Renewal

Regulatory changes can also play a role in the mortgage renewal process. Policies set by financial authorities can lead to adjustments in lenders’ approaches to renewals and risk assessment. An example is the simplified mortgage stress test for insured mortgages, which has been loosened for insured mortgages. Many times, these sort of lender policies changes typically end up being more direct restrictions from OSFI or the Bank of Canada rather than internal requirements.

Lender’s Perspective: Understanding Mortgage Deselection

Lenders are increasingly cautious in their mortgage portfolios, especially in fluctuating economic climates. Mortgage deselection, while rare, is a part of this cautious approach, primarily used in situations where the risk associated with the mortgage is deemed too high.

Risk Assessment and the potential need to deselect a mortgage

Risk assessment is a critical component in a lender’s decision to renew a mortgage. This includes evaluating factors like the current loan-to-value (LTV) ratio, the borrower’s creditworthiness, pre existing relationship, and the overall economic climate. Lenders use these assessments to decide whether to offer renewal, adjust terms, or, in extreme circumstances, deselect a client, although this is rare.

How Economic Conditions Affect Lender Decisions

Economic conditions, including interest rates and market stability, play a significant role in mortgage renewal decisions. In times of economic uncertainty, lenders may become more stringent in their risk assessments, impacting their renewal policies.

In a volatile market, it’s more important than ever to understand your lender’s perspective. Being aware of how economic conditions might affect their decision can help you prepare for your renewal discussion. A Mortgage Broker will also have up to date knowledge on the current financial health of each lender which can assist in knowing if it makes sense to stick around with your current bank.

Navigating Potential Mortgage Non-Renewal

For homeowners facing the possibility of non-renewal, understanding the mortgage renewal process is crucial. Awareness of the criteria used by lenders for renewal decisions can aid in preparing for various scenarios.

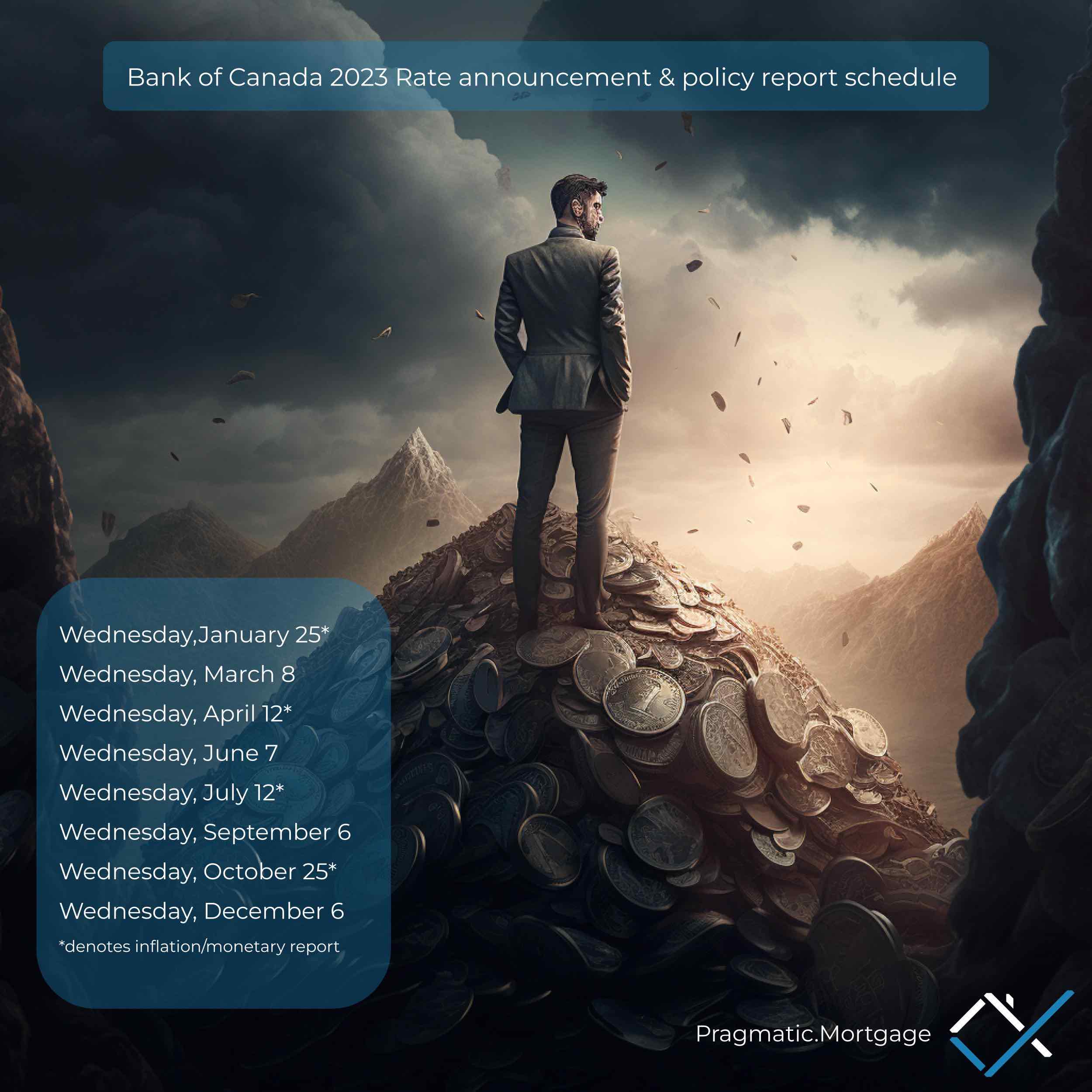

Preparing for Your Mortgage Renewal Conversation

Engaging in a conversation with your lender well before your mortgage renewal can provide clarity on their renewal criteria and offer an opportunity to address any potential concerns. It is typical to lock in a rate option 120 days before your renewal date. However, you should start conversations with your current lender and mortgage broker at least 2 months before this period to understand your options. You should be discussing plans in January and the strategy to find the best option at the 4 month window which would be sometime in March. This proactive approach is beneficial in securing a favorable renewal outcome.

Staying Financially Healthy

Maintaining a good credit score, ensuring timely mortgage payments, and managing other debts effectively are crucial for a smooth mortgage renewal process. These factors demonstrate to lenders that you are a low-risk borrower.

Using Online Tools to Evaluate Your Property

Tools like the British Columbia online BC assessment website can be valuable in determining the estimated annual value of your property. Such tools can help you understand one of the key factors lenders consider during the renewal process.

“Leverage online resources to get a clear picture of your property’s value. This information is vital in your renewal discussions to build a strong case for your lender to continue to work with you if they do threaten non-renewal. The higher your equity, the more you are in the driver’s seat.” advises Wilson.

Online Mortgage Calculators

Today’s technology offers innovative tools for you to see the full picture pre and post renewal. Using sophisticated Mortgage Calculating Tools will help you get a full picture beyond a monthly payment. Instilling confidence in the best case renewal solution.

Staying Ahead in the Mortgage Game

The concept of mortgage deselection, while not common, is a reminder of the ever-changing landscape of the mortgage industry. The mortgage renewal process will be straightforward for most homeowners, particularly those who have maintained a good payment record and financial health. However, for those with concerns or potential red flags in their mortgage journey, it’s crucial to consult with a mortgage broker and develop a strategy for the best renewal possible.

Key Takeaways for Homeowners

1. Understand the Factors: Be aware of the factors influencing mortgage renewals, such as economic conditions, property value, and your financial health.

2. Be Proactive: Engage in conversations with your lender and seek advice from mortgage professionals well before your renewal date.

3. Explore Options: Consider alternative lending options and shop around to ensure you’re getting the best possible terms.

4. Stay Informed: Keep up with market trends and regulatory changes to understand how they might impact your mortgage renewal.

Empowering Mortgage Holders for Successful Renewals

By staying informed, proactive, and prepared, homeowners can navigate the mortgage renewal process with confidence. While mortgage deselection is possible, understanding your position and having a clear strategy can significantly reduce this risk. Remember, the key is not to panic but to be prepared and informed, ensuring the best outcome for your mortgage renewal.

In conclusion, although the term ‘mortgage deselection’ may seem daunting, it is a rare occurrence in the mortgage industry. The focus should be on understanding the process, maintaining a healthy financial profile, and seeking professional advice to navigate any potential challenges successfully. With the right approach and preparation, homeowners can confidently manage their mortgage renewals and stay ahead in the ever-evolving mortgage landscape.