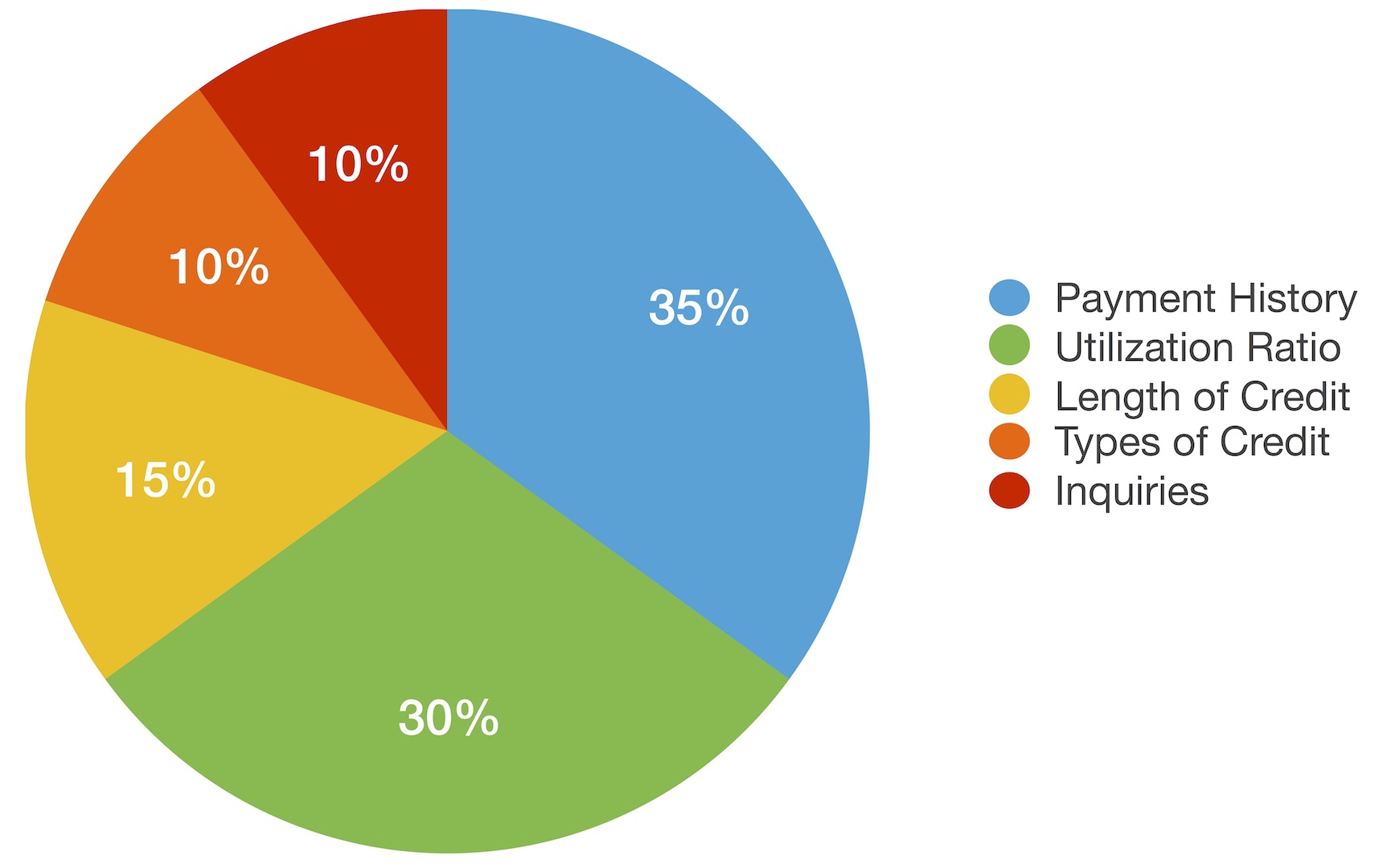

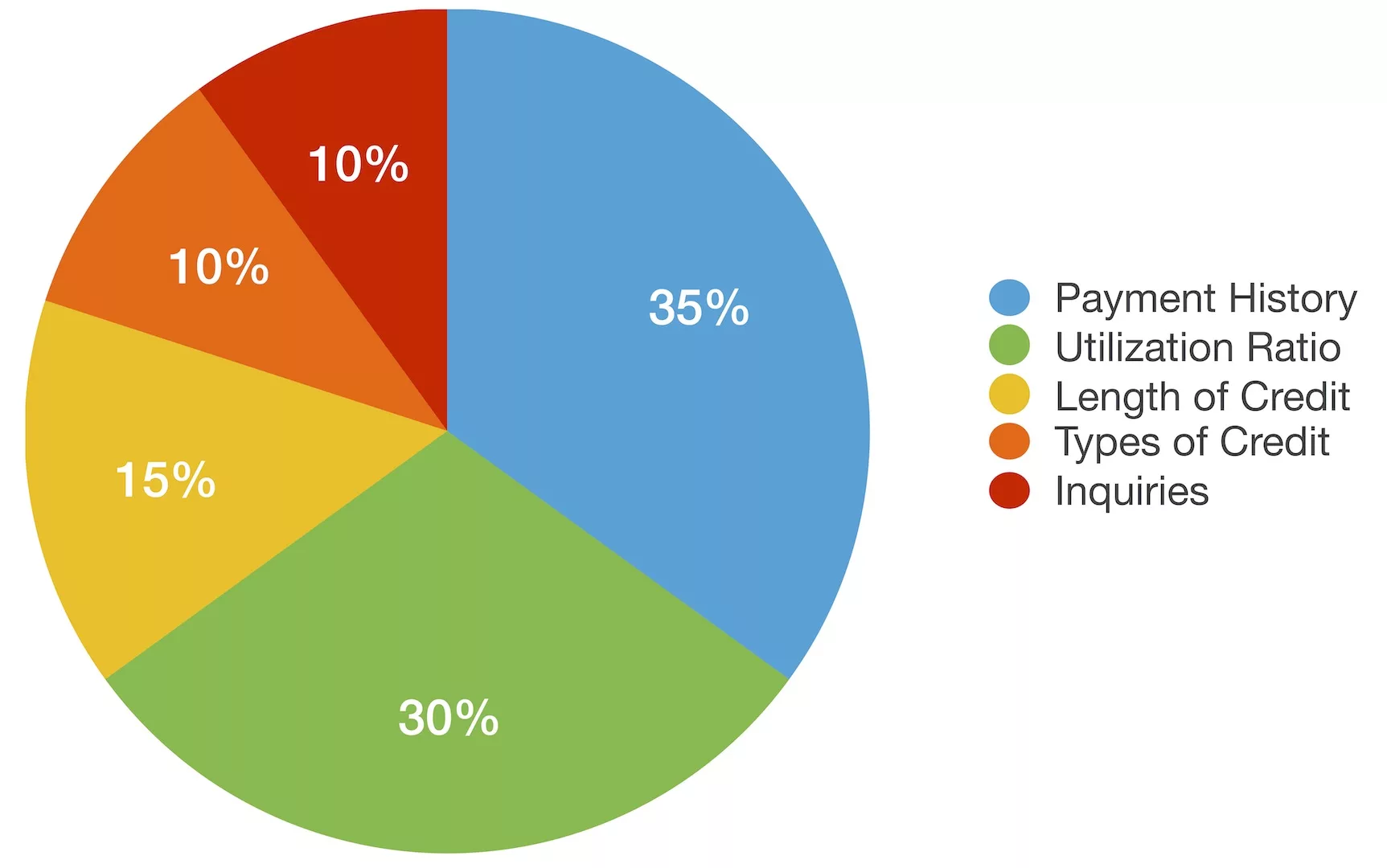

What Makes Up Your Credit Score?

The algorithm for calculating your Equifax / Transunion Credit Score can be rather mind boggling. However, it’s actually quite simple what impacts your beacon, and why. Below are the 5 key components of what makes up your credit score:

Payment History

This makes up about 35% of your score, it’s crucial to pay your bills on time. Even if you miss $5 dollar payment on a credit card, it can produce the same negative effect as missing a $500 payment! Don’t skip minimum payment requirements. Always be aware of whom you owe money to—even if it’s just a parking ticket; left too long and this could go to collections which will damage your score immensely!

Utilization Ratio

This is your level of indebtedness. This is how much of your total available credit you’re using. Try to keep your balance below 35% of your credit limit, and don’t ever go over 70%, even if you pay it off every month. For example, if you have a $10,000 Credit Card, don’t allow the limit to exceed $7,000. It is better to obtain a seperate credit card or increase your limit, then to go beyond the 70% utilization ratio.

Length of Credit

The longer you have an account open, the better. Think of it as a good track record. It shows you’re capable of managing credit.

Types of Credit

It’s good to have a mix of different types of credit to show that you can manage your financials well. But use caution as to what types of credit you have.

For example: A mortgage reporting on your credit history will produce a strong beacon score vs. a payday loan which can show you are a higher risk borrower.

General rule of thumb: Have at least 2 credit cards, a line of credit, and a mortgage reporting for at least 2 years plus and you will be a beacon stud!

Did you know?: 95% of banks require you to have at least 2 credit cards for a minimum of 2 years if you wish to qualify for “A” Credit rates!

Inquiries

These happen every time you agree to look to obtain credit. But there is a big difference between a Hard Inquiry and a Soft Inquiry.

A hard inquiry happen’s when you open a bank account, a credit card, an auto loan etc.

A soft inquiry is when you search your credit history personally, or I help you obtain an report without “inquiring for credit”.

Note: Equifax and Transunion view credit inquiries for different types of credit within the similar time frame as a major red flag that will impact your score. If you are shopping for a mortgage, don’t shop for a Hot Tub or Auto Loan during this period, it could affect your approval!