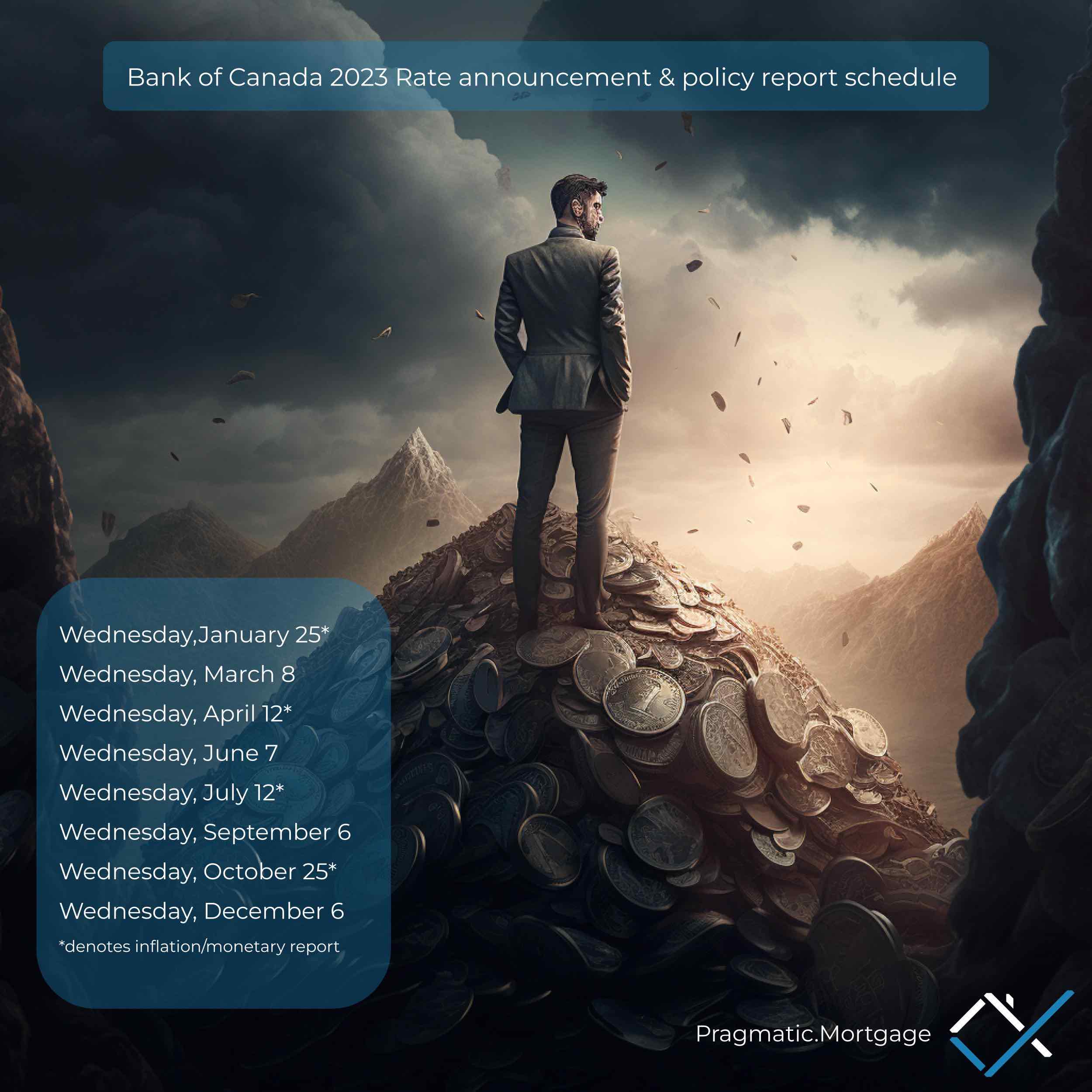

Interest rate announcements in 2023

The Bank of Canada has recently announced its schedule for interest rate announcements in 2023. The central bank will be making its interest rate announcements on the following dates: January 19, March 9, April 13, May 25, July 13, September 7, October 19, and December 7.

These announcements are closely watched by economists, investors, and consumers alike, as they can have a significant impact on the economy and on individual financial decisions. The interest rate, also known as the overnight rate, is the rate at which banks can borrow money from the Bank of Canada overnight. This rate serves as a benchmark for other interest rates in the economy, such as those on mortgages, loans, and savings accounts.

Why is this important

In general, when the Bank of Canada raises interest rates, it is trying to slow down the economy and curb inflation. When it lowers rates, it is trying to stimulate economic growth and encourage borrowing and spending. The Bank of Canada has been holding its interest rate at a record low of 0.25% since March 2020 due to the economic fallout from the COVID-19 pandemic, but it will likely start increasing rates in 2023 as the economy recovers.

Pragmatic Mortgage Lending will be providing updated information to dissect the decision based on current events and what to expect next. We will be analyzing each interest rate announcement, looking at the bank’s statement and any other relevant economic data to help you understand the implications for the economy and for your own financial situation.

For example, if the bank raises interest rates, it will mean that borrowing costs will go up, which could make it more expensive for consumers to take out mortgages, loans, and credit cards. On the other hand, savers may benefit from higher interest rates on their savings accounts. Businesses may also be affected, as higher interest rates can make it more expensive for them to borrow money for investments and expansion.

As the Bank of Canada’s interest rate announcements can have a major impact on the economy, it is important to stay informed about what to expect and how the decisions may affect you. Pragmatic Mortgage Lending will be providing you with the most up-to-date information and analysis so you can make informed decisions about your own financial situation.

2023 Outlook

Overall, the schedule of interest rate announcements by the Bank of Canada will be closely watched throughout 2023 as the economy continues to recover from the pandemic. Pragmatic Mortgage Lending will be providing you with the most up-to-date information and analysis to help you understand the implications of each announcement and how it may affect your own financial situation.

It is important to note that these decisions are not just a one time event, but a series of decisions that will affect the economy and the markets, it is crucial to stay informed and be aware of the potential implications for your own financial well-being. With the help of Pragmatic Mortgage Lending, you can make informed decisions and navigate through the interest rate announcements in 2023.