How it Started

The banking system in Canada has a long and rich history that dates back to the early days of European settlement. The first banks in Canada were established in the late 1700s, and were primarily focused on providing financial services to the wealthy and powerful individuals and businesses of the time. Over the years, the banking system in Canada has evolved and expanded to meet the changing needs of the population, and today it is a vital component of the Canadian economy.

The early days of banking in Canada were marked by a lack of regulation and oversight, which led to a number of financial crises and scandals. In response to these issues, the government began to take a more active role in regulating the banking industry, and in 1871 the Bank Act was passed, which established the Bank of Canada as the central bank of the country. This act also established a number of regulations and oversight mechanisms to ensure that the banking industry was operating in the best interests of the public.

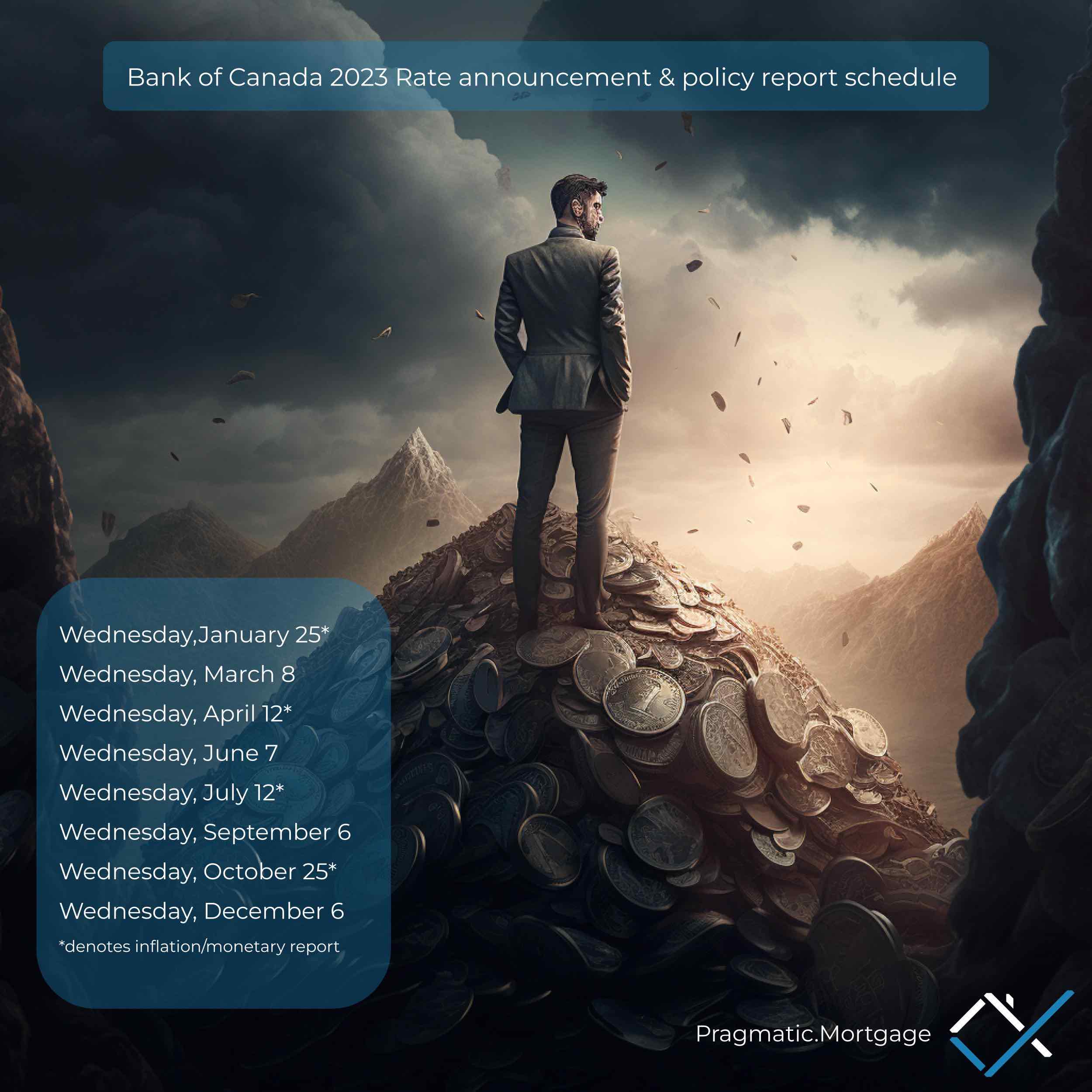

The Modern Era.

Today, the banking system in Canada is made up of a number of different types of financial institutions, including commercial banks, credit unions, and trust companies. These institutions provide a wide range of services to Canadians, including savings accounts, checking accounts, loans, mortgages, and credit cards. The Bank of Canada plays a key role in overseeing and regulating the banking industry, and is responsible for maintaining the stability and integrity of the financial system.

One of the most important and complex aspects of the banking system in Canada is the process of balance sheet mortgage lending. This type of lending is used to finance the purchase of a home, and is typically done through a mortgage broker or a bank. The process begins with the borrower applying for a mortgage, and providing the lender with information about their income, credit history, and assets. The lender then assesses the borrower’s ability to repay the loan, and decides whether or not to approve the mortgage.

Once the mortgage is approved, the lender will typically require the borrower to provide a down payment, which is a percentage of the purchase price of the home. The lender will then hold the mortgage, and will make payments to the borrower over a set period of time, typically 25-30 years. The borrower will also be required to make regular payments to the lender, which will include both interest and principal.

The balance sheet mortgage lending process can be a bit complicated, but it is essential for ensuring that the banking system in Canada is able to function properly. By requiring borrowers to provide a down payment, and by requiring regular payments, lenders are able to ensure that they are lending money to borrowers who are able to repay the loan. This helps to minimize the risk of default and financial instability, and ensures that the banking system is able to continue to provide the services that Canadians need.

What if the Bank runs out of out the “balance sheet”?

Canadian banks get the money to lend people for a mortgage through a variety of different sources. One of the main sources is deposits from customers. When customers open savings accounts, chequing accounts, or other types of accounts, they deposit money into the bank. This money is then used by the bank to lend to borrowers for mortgages and other loans.

Another source of funds for Canadian banks is borrowing from other financial institutions. Banks can borrow money from other banks, credit unions, and investment companies. This is known as wholesale funding, and it allows banks to access larger amounts of capital than they would be able to through customer deposits alone.

Canadian banks also raise money by issuing bonds and other securities. This is known as capital market funding, and it involves the bank issuing debt securities to investors. The investors then lend money to the bank in exchange for the bond or security, and the bank can then use this money to lend to borrowers.

In addition to these sources of funding, Canadian banks also have access to funds from the Bank of Canada. The Bank of Canada provides liquidity to the banking system through its discount window, which allows banks to borrow money at a low interest rate in times of need. This helps to ensure that the banking system is stable and that banks have the funds they need to lend to borrowers.

In conclusion, the banking system in Canada has a long and rich history, and has evolved to meet the changing needs of the population. Today, the banking system is made up of a number of different types of financial institutions, and is overseen and regulated by the Bank of Canada. Balance sheet mortgage lending is one of the most important and complex aspects of the banking system, and is essential for ensuring that the system is able to function properly. By understanding the history of the banking system in Canada, and how balance sheet mortgage lending works, we can better appreciate the vital role that the banking system plays in our economy and our daily lives.