As the Canadian housing market continues to adapt, so do the regulations that shape it. The Mortgage Stress Test, a protective measure in place for homeowners, has undergone significant revisions. For potential and current homeowners, understanding these changes is crucial for making informed decisions. In this article, we’ll unpack what the recent updates to the Mortgage Stress Test mean for you, why they’re important, and how they can affect your mortgage strategy.

The Mortgage Stress Test: Understanding Recent Changes

The Canadian government’s recent amendments to the Mortgage Stress Test represent a significant shift in the housing finance landscape. These changes, pivotal for current and prospective homeowners, reflect a responsive approach to the financial realities faced by many Canadians. Understanding these adjustments is essential to effectively navigate your mortgage options in today’s market.

The Removal of the Stress Test for Insured Mortgage Renewals

In a substantial policy update, the stress test requirement has been removed for those renewing their insured mortgages, even when switching lenders. This adjustment is designed to empower homeowners, granting them the flexibility to seek out better rates and terms at renewal time without the worry of passing a stringent stress test. This is particularly impactful in our current economic climate, where homeowners may be facing higher interest rates and looking for relief. The elimination of the stress test for renewals means you have the opportunity to shop for more competitive rates and can freely switch lenders to better suit your financial situation.

The Canada Mortgage Charter: A New Era of Borrower Empowerment

Complementing the updated stress test rules is the introduction of the Canada Mortgage Charter. This initiative sets a new standard in the mortgage industry, focusing on principles that support and protect borrowers throughout their mortgage experience. With a strong emphasis on transparency and fairness, the Charter ensures that lenders provide comprehensive, clear information, making it easier for you to understand and navigate the mortgage landscape. This borrower-centric approach aims to not only inform but also empower you, giving you more control over your mortgage decisions.

Why the Changes Matter: Impact on Canadian Homeowners

The recent updates to the Mortgage Stress Test regulations are not mere procedural tweaks; they carry significant consequences for Canadian homeowners. These changes reflect a deliberate strategy to enhance financial flexibility and reduce the potential stress associated with mortgage management in an uncertain economic environment.

Greater Flexibility in Mortgage Renewal and Lender Switching

The newfound ability to renew mortgages without a stress test offers homeowners the freedom to negotiate with various lenders, unhindered by the fear of failing stringent qualifying criteria. This shift not only has the potential to save you thousands of dollars over the life of your mortgage but also encourages a more competitive lending environment. Homeowners can now approach mortgage renewal with a stronger bargaining position, leading to potentially better financial outcomes.

The Impact on Mortgage Rates and Market Competitiveness

The ripple effects of these changes are expected to extend beyond individual homeowners to the broader market. Lenders, now faced with the reality that homeowners are no longer ‘captive’ at renewal time, may adjust their rates and terms to be more attractive. This could stimulate a more competitive marketplace, where you benefit from lower rates and more flexible mortgage products. Moreover, this increased competition may drive overall market conditions towards a more consumer-friendly state, where transparency and value take precedence.

The Practical Implications for You as a Homeowner

While policy changes can often seem distant and disconnected, the alterations to the Mortgage Stress Test have tangible implications for your day-to-day financial decisions and long-term planning.

How to Leverage the New Rules to Your Advantage

With the removal of the stress test for mortgage renewals, you now have a prime opportunity to reassess your mortgage conditions. It’s an ideal time to shop around, compare offers, and negotiate terms that align with your current financial situation and future goals. Whether it’s securing a lower interest rate, adjusting your payment schedule, or accessing home equity, the changes afford you a level of agency that was previously constrained.

Strategies for Mortgage Renewal Under the New Guidelines

Approaching mortgage renewal strategically can result in substantial savings and improved financial flexibility. Start by evaluating your current mortgage against the market to understand your position. Consider consulting with a mortgage advisor to explore your options and prepare for negotiations. With the leverage you now hold, it may also be the right time to discuss any financial changes or future plans that could affect your mortgage, ensuring your new terms will be a fit for years to come.

Expert Insights: How the Changes Shape the Market

Industry experts are weighing in on the broader implications of the updated Mortgage Stress Test, forecasting how these reforms may reshape the housing and financial markets.

Industry Perspectives on the Shifts in Mortgage Regulation

Financial analysts and housing market experts predict that the removal of the stress test for mortgage renewals will create a more dynamic lending environment. “This is a turning point for the mortgage industry,” says a noted financial strategist. “It encourages innovation and responsiveness from lenders, which can only benefit consumers. The landscape is now more favorable for homeowners to manage their mortgages proactively.”

Predictions for the Housing Market Post-Changes

As homeowners gain the flexibility to renegotiate their mortgages with greater ease, experts anticipate increased activity in the housing market. This could lead to a more vibrant and fluid market, with lenders offering a variety of mortgage products tailored to meet diverse homeowner needs. Such a market not only benefits individual homeowners but also stimulates economic growth as more people are enabled to participate in homeownership. The long-term impact could be a gradual uplift in housing demands, property values, and a surge in buyer confidence as the mortgage process becomes less daunting.

Your Next Steps in the Updated Mortgage Landscape

With the landscape of mortgage rules shifting, it’s essential to consider how to navigate these changes effectively. The following steps can ensure you are well-positioned to take advantage of the new regulatory environment.

Seeking Professional Guidance for Better Mortgage Deals

Given the complexity of mortgage regulations and the intricacies of financial planning, seeking professional guidance is more crucial than ever. A mortgage broker or financial advisor can provide personalized advice, helping you to understand how the changes specifically affect your situation. They can also assist in negotiating with lenders, ensuring you get the best possible terms based on the new regulations.

Long-Term Considerations and Financial Health

As you adapt to the updated mortgage rules, it’s important to keep long-term financial health in the forefront. Consider how changes in your mortgage terms might affect your financial goals, such as retirement planning or investments. It’s wise to view your mortgage as part of your broader financial picture, not in isolation. Evaluate how refinancing or adjusting your mortgage could interact with other financial commitments and opportunities. Making the right moves now could set the stage for a more secure and prosperous future.

Adapting to the Mortgage Stress Test Requirements

Canada’s Mortgage Stress Test revisions mark a significant evolution in mortgage regulation, reflecting a shift towards consumer empowerment in the financial landscape. These changes herald a new chapter for current and prospective homeowners, one that promises more autonomy and potential financial benefits. As we navigate this altered terrain, it’s imperative to remain informed, proactive, and prudent in our mortgage-related decisions.

For homeowners, the updated regulations offer a chance to reassess and potentially improve their mortgage conditions. Prospective buyers may find the market more accessible, opening up opportunities for homeownership that previously seemed out of reach. Across the board, the mortgage process now demands a more strategic approach, encouraging individuals to seek advice, compare options, and choose paths that align with both their immediate financial realities and their long-term aspirations.

Canada’s Mortgage Stress Test FAQs.

The mortgage stress test is a formula used by lenders to determine whether a borrower can maintain their mortgage payments in the face of increased interest rates. It involves qualifying for a mortgage at a higher rate than the actual rate being offered to ensure financial stability and preparedness for potential rate hikes in the future.

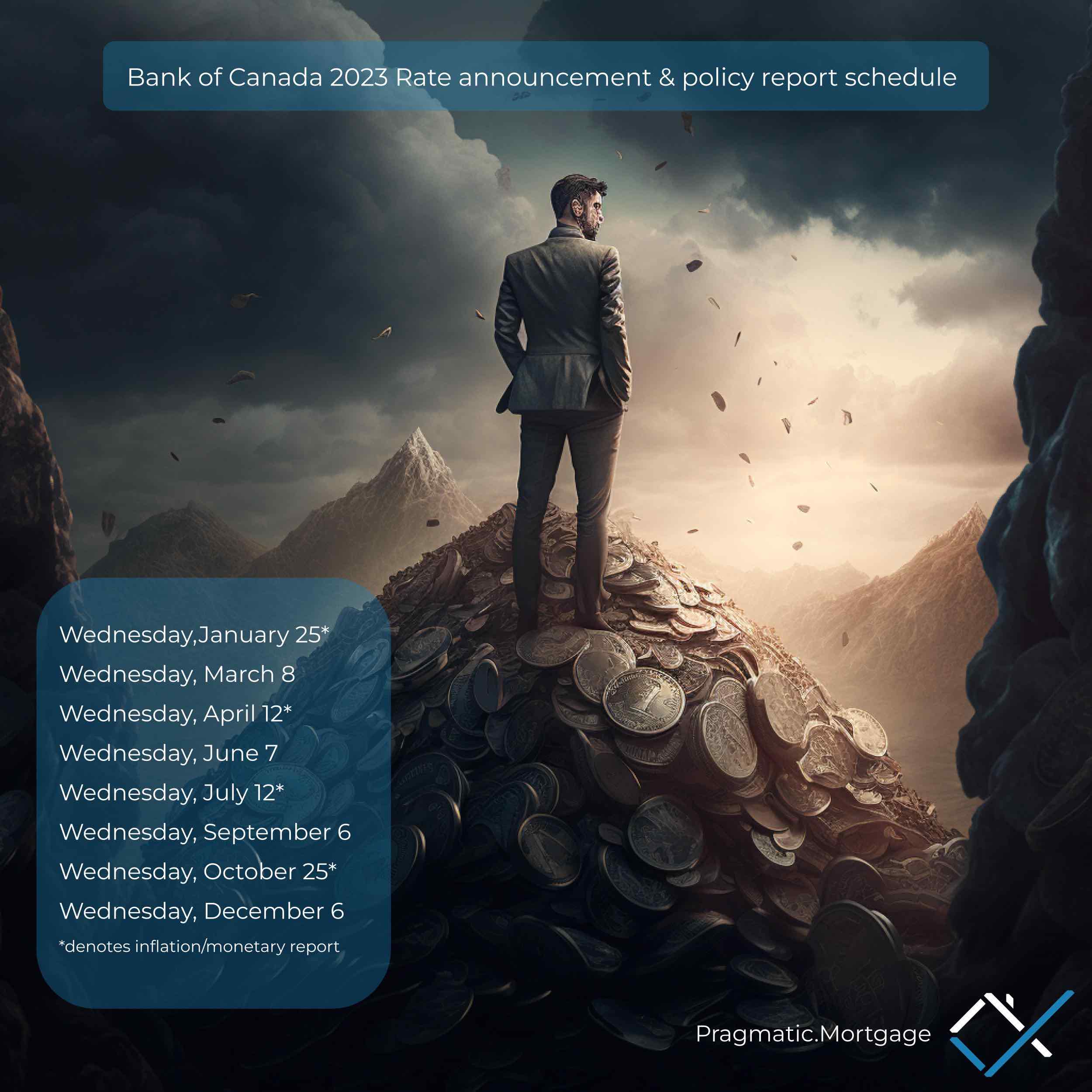

As of the latest update, the qualifying rate for the mortgage stress test is set by the Bank of Canada’s five-year benchmark rate or the rate offered by the lender plus 2%, whichever is higher. This rate is subject to change, so it’s essential to check with financial institutions or a mortgage advisor for the most current information.

To calculate the stress test for a mortgage, you would apply the higher qualifying interest rate to your mortgage amount using a standard mortgage payment calculation. This assesses your ability to make mortgage payments at this elevated rate, factoring in your loan principal, amortization period, and frequency of payments. For example:

- Your interest rate is 4.45%

- Your mortgage balance if $300,000

- Your amortization is 25 years.

- Your true monthly payment is: $1652.09

However, with the stress test we must simulate 2% above your true rate. At 6.45% your monthly payment stress tested is $2000.39.

Although your true payment will be 1652.09. The income to debt ratio will be simulated at $2000.39. This reduces your buying power by $348.30 monthly.

The new mortgage stress test rules have notably removed the testing requirement for mortgage renewals with a different lender if yourt mortgage was originally insured, allowing for more flexibility and competitive options for homeowners so they are not forced to stay with their current lender. The amendment aims to assist homeowners in managing their mortgages more effectively in the current economic environment, fostering a marketplace where consumers can shop for better rates without the constraint of the stress test.